The motor industry may be in turmoil as global policy changes and uncertainty rock manufacturing and potentially exports, but South African consumers continued to show their demand for new vehicles during April.

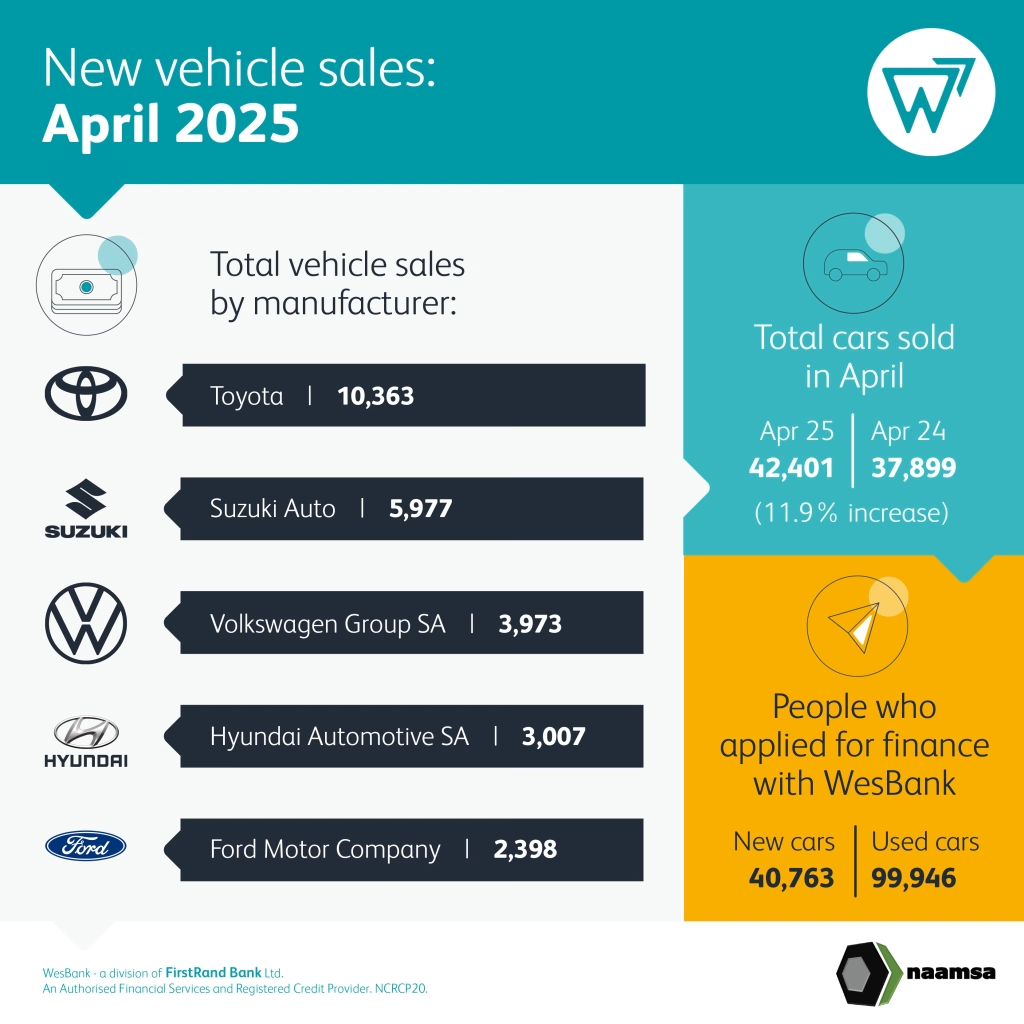

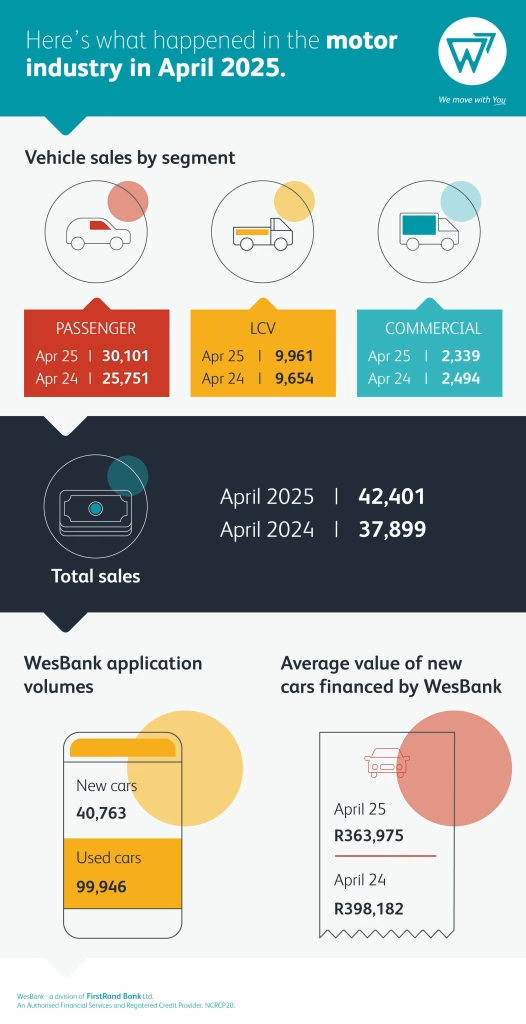

According to data from naamsa | the Automotive Business Council, April new vehicle sales continued the momentum built over the past seven months and continued to grow. And not just display growth – but double-digit growth; the market up 11,9% to 42,401 units.

“Year-on-year comparisons need to be contextualised in terms of selling days,” says Lebo Gaoaketse, Head of Marketing and Communication at WesBank. “April was disrupted by three public holidays and long weekends resulting in only 19 selling days whereas April 2024 had 21 selling days given the public holidays fell into March last year.”

This makes April’s sales growth even more formidable and shows the determined resilience of the market to return to pre-COVID-19 levels.

Consumers were relieved of any increase in VAT but continue to face budget constraints despite published inflation lowering during March to 2,7%. Whilst that may not translate into interest rate relief any time soon, applications for finance continue to show heightened demand for new vehicles and buoy the market to pre-COVID-19 levels.

“The market also appears to be correcting itself, balancing affordability with demand as consumers become more realistic about their purchase decisions,” says Gaoaketse. WesBank data shows an average deal size shrinking 8,6% year-on-year, indicating the stresses of affordability on new vehicle purchases and the continued trend to buy-down into smaller, more affordable vehicles. “The competitive price point of new Chinese entrants will also be influencing this shift as consumers seek alternative value in the market.”

Once again, passenger cars drove the market, up 16,9% to 30,101 units. But so robust has the market growth momentum been that even Light Commercial Vehicle sales were up 3,2% to 9,961 units, the segment having been in negative growth for many months.

“Although April sales displayed growth of 4,502 units year-on-year, the cyclical normality of slower sales during the start of the second quarter meant 7,059 units less than March,” says Gaoaketse. “While local sales are not expected to be impacted directly by policy decisions in the US in the short-term, the longer-term impacts on consumer and business sentiment – as well as any potential economic fallout affecting household budgets – could begin to be felt later in the year. For the moment, the SA new vehicle market shows positive signs of growth momentum, which is good all round for consumers and the economy alike.”

April sales results mean the market is 10,6% ahead of sales for the same period last year, year-to-date volumes registering 186,433 new vehicles so far this year.