Positive momentum continued to build for the new vehicle market during November, with sales for the month replacing October as the best sales month of the year. The strong performance was driven by fleet deals from the rental companies as consumer demand softened year-on-year.

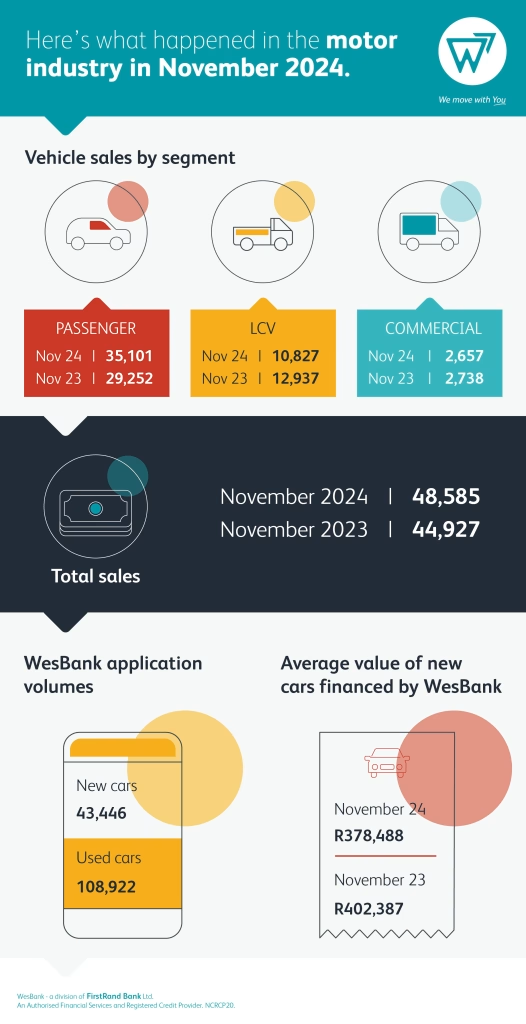

New vehicle sales reported its second consecutive month of substantial year-on-year growth, recording 48,585 sales, up 8,1% on November 2023 sales according to naamsa | the Automotive Business Council. Not only was November the year’s best sales month, but also the largest market growth of the year. October sales had been 5,5% up year-on-year.

“November sales are the best performance for the market since March last year (50,114 units),” says Lebo Gaoaketse, Head of Marketing and Communication at WesBank. “But there is a lot more momentum to create before the country’s automotive industry can rest easier on a recovery path.”

November sales were driven by a substantial uptick in rental volumes, driving passenger car sales up 20% to 35,101 units and accounting for all of the market’s growth during the month. By contrast, Light Commercial Vehicle sales were once again significantly lower, down 16,3% to 10,827 displaying the ongoing volatility of the market and remaining signs of caution despite the headline results.

“Consumers remain under severe household budget constraints, displayed in two key pieces of WesBank data,” says Gaoaketse. “The average deal size financed by the bank is 6% lower year-on-year for new vehicles, indicating affordability concerns amidst new car price inflation. In addition, despite sales being significantly higher than a year ago, demand as measured by applications has softened substantially.”

The result is potentially the realisation of pent-up demand being satisfied and the sheer realities of household income drying up. By contrast, applications for used vehicle finance are down half as much as new vehicles, whilst the value of these deals has increased marginally.

“Consumers have welcomed the second interest rate cut and will be hoping for the trend to continue,” says Gaoaketse. “In addition, the energy crisis is seemingly under control, inflation lower for five consecutive months, the currency performing better, and fuel prices contributing to budget savings – but all this positive impetus will take time to filter through to overall market performance and general consumer affordability.”

The impact of October and November sales can certainly be felt in the market’s year-to-date performance. With 474,469 units sold over the 11 months, the market has recovered to being 3,5% lower than the same period last year.

“The market’s year-to-date performance remains the reality check for the industry,” says Gaoaketse. “We continue to be on the slow path of recovery and whilst positive market growth for two months should be celebrated, cyclically softer December sales should be expected as consumers delay purchase decisions into the new year. However, the market remains primed for some stability during 2025 if October and November performances can be sustained.”