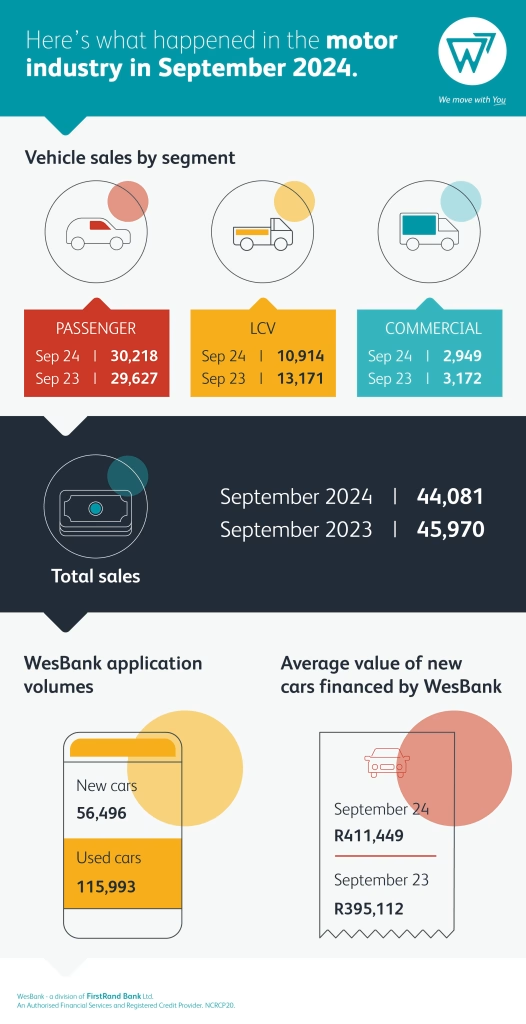

While the country welcomed the cut in interest rates during September, it wasn’t enough to stimulate new vehicle sales during the month. According to data released by naamsa | the Automotive Business Council, the South African new vehicle market declined 4,1% year-on-year to 44,081 units.

The South African Reserve Bank made the much-anticipated decision to cut interest rates by 0,25% during September, the first of what consumers and economists alike hope is the start of a cutting cycle over the next 18 months.

“Cumulatively these cuts will begin to impact indebted consumers over time and provide some level of relief in expensive debt,” says Lebo Gaoaketse, Head of Marketing and Communication at WesBank. “However, the immediate effects are practically small; but philosophically provide a stimulus to the market in sentiment.”

The quarter percentage saving on a typical vehicle finance agreement over 72 months is only R13,08 per R100,000. “This translated into the relatively poor performance of the new vehicle market in September, albeit sales were robust,” says Gaoaketse.

Despite the poor performance on paper, new vehicle volumes for September were the third-best sales month for the year and were only 148 units behind the positive volume growth in July that had everyone excited. September sales were also 1,1% or 493 units up on August sales, showing positive sentiment creeping into the market. Also of relevance is that the month had two fewer selling days than September last year.

“The September market performed at similar volumes to those experienced in the beginning of the year and where the market was towards the end of 2019, showing that the slow recovery continues,” says Gaoaketse. “With the expectation of stimulated trading conditions over the next 18 months, the new vehicle market can be expected to perform better as consumers slowly reap the rewards of debt savings.”

The passenger car market continued to bolster sales, up 2% to 30,218 units, once again breaching the 30,000-unit volume and surpassing 250,000 units (252,093) year-to-date.

Light Commercial Vehicles performed better than August, September sales down 17,1% to 10,914 although the segment remains the hardest hit year-to-date with volumes down 11,6%.

Overall, the market continues to recover in the longer term, year-to-date sales recovering a further 0,3% (August year-to-date recovered 0,2%) to set the total market volume at 377,835, which is 5,8% down on the first nine months of 2023.

“Sentiment is shifting more positively, which will provide good impetus for the country’s new vehicle market,” says Gaoaketse. “Volumes remain robust and demand remains high, all positive conditions for improving market performance.”