New vehicle sales continued to defy economic turmoil in March to mark six consecutive months of year-on-year growth and round out two optimistic quarters of growth for the South African motor industry. March new vehicle sales were the best since March 2023, nudging the 50,000-unit volume and placing the market firmly at pre-COVID-19 levels.

March sales volumes come at a time when other economic indicators are performing in the other direction in the face of global political uncertainty. Local economic headwinds are also providing more challenges than positives. Interest rates were held unchanged at the last review despite forecasts for cuts throughout this year and volatile exchange rates are bouncing towards more negative growth. While inflation numbers remain contained and fuel prices show some resilience and relief, South African consumers appear unphased and are ordering new vehicles.

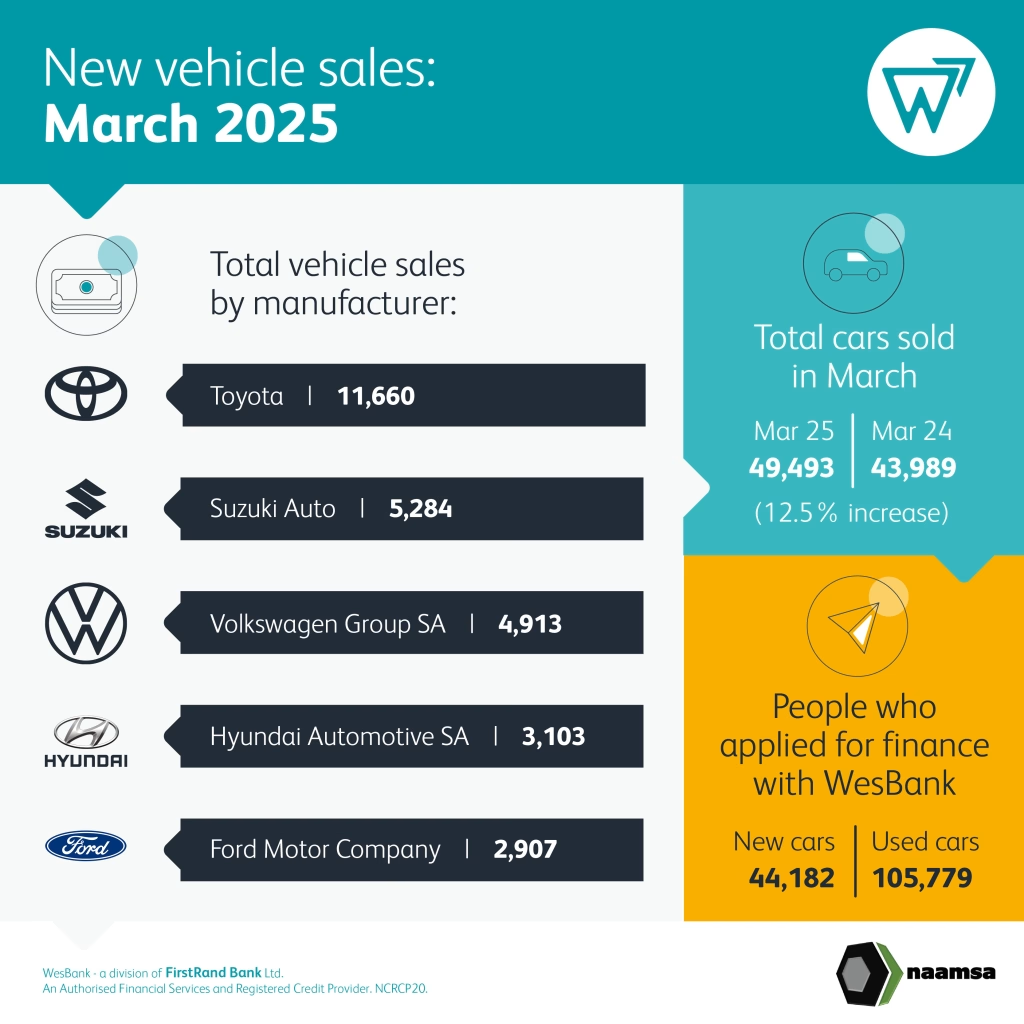

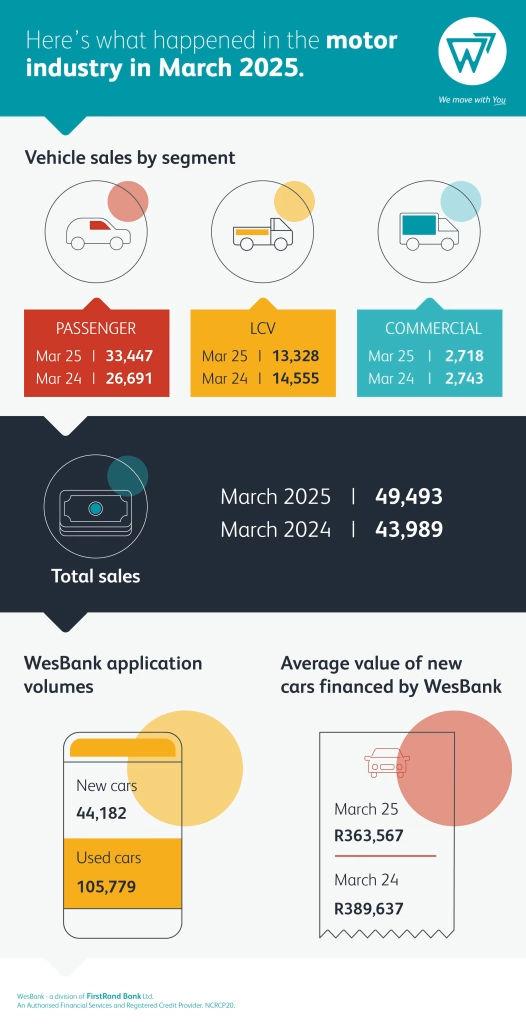

According to data from naamsa | the Automotive Business Council, March new vehicle sales jumped 12,5% to 49,493 units – the biggest growth since June 2023, which were coming off a relatively low and recovering base post-COVID-19.

The growth came from the dealer floor and the demand was for passenger vehicles. The passenger car segment climbed 25,4% to 33,447 units, a substantial 6,756 more vehicles than March last year. The rental market accounted for 3,174 cars, a fairly usual volume despite being up 54,4% year-on-year.

“While the pending increase in VAT only amounts to R500 per R100,000 we expect that some purchase decisions will have been accelerated by its imminent implementation,” says Lebo Gaoaketse, Head of Marketing and Communication at WesBank. “While interest rates remained unchanged during the month, their levels have alleviated some affordability, stimulating demand in the market for new vehicles. WesBank has also experienced a reduction in balloon amounts financed year-on-year, reinforcing the positive improvements in affordability in the market.”

More sobering than the euphoria of the passenger car segment, Light Commercial Vehicles once again suffered, down 8,4% to 13,328 units.

First quarter sales posted a positive 10,5% growth to 144,426 units, injecting 13,691 more vehicles into the market than in the first three months of last year.

“The arrival of more and more Chinese brands and products is certainly creating more volume for the market at affordable prices with attractive specification levels,” says Gaoaketse. “Some of these sales are winning market share from legacy brands, indicating a shift in buying behaviour as consumers become more product conscious and less brand conscious in their vehicle choice.”

With relief at the pumps thanks to substantial decreases across the fuel board during April, consumer confidence should remain as bullish as first quarter sales would suggest, providing a strong impetus for second quarter sales. However, political and economic uncertainties continue to prevail, which could impact the growth trajectory.