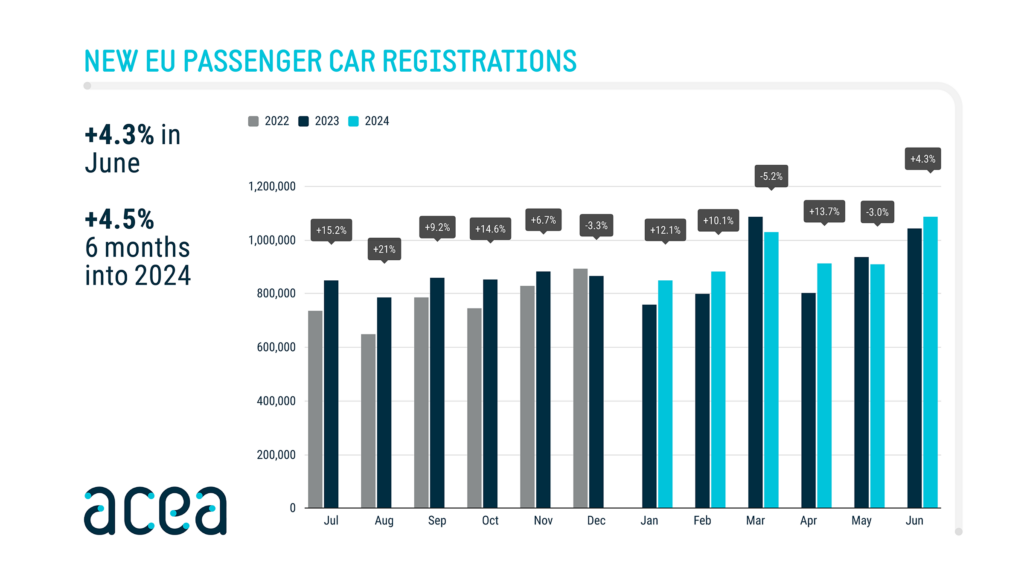

In June 2024, EU car registrations increased by 4.3%, driven by gains in three out of the region’s four major markets: Italy (+15.1%), Germany (+6.1%), and Spain (+2.2%). In contrast, France saw a decline of 4.8% last month.

In the first half of 2024, new car registrations increased by 4.5%, reaching nearly 5.7 million units. However, registration volumes remain relatively low (-18%) compared to pre-pandemic levels. The bloc’s largest markets all showed positive but modest performance, with Spain (+5.9%), Germany (+5.4%), Italy (+5.4%), and France (+2.8%) all recording growth.

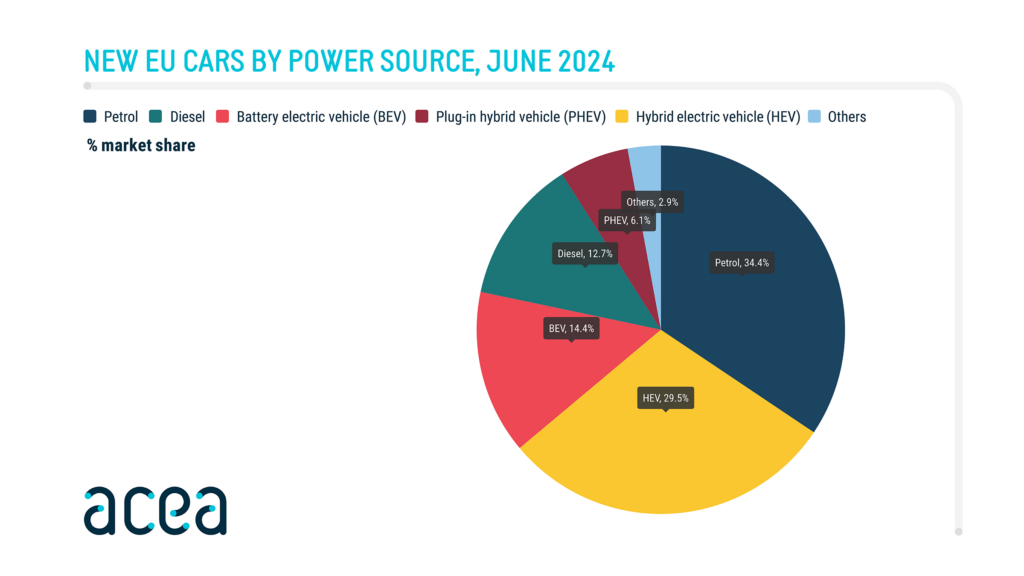

New EU car registrations by power source

In June, battery-electric cars accounted for 14.4% of the EU car market, down from 15.1% the previous year. At the same time, hybrid-electric vehicles increased their market share, growing from 24.4% to 29.5%. The combined share of petrol and diesel cars fell to 47.1%, down from 49.6%.

Electric cars

In June 2024, registrations of battery-electric (BEV) cars declined by 1% to 156,408 units, with their total market share dropping to 14.4% from 15.1%. Despite significant growth in Belgium (+50.4%) and Italy (+117.4%), these gains could not offset double-digit declines in the other top markets: Germany (-18.1%), the Netherlands (-15%), and France (-10.3%). As a result, a total of 712,637 new battery-electric cars were registered in the first half of the year. This marks a modest 1.3% increase from the same period the previous year, and represents 12.5% of the market.

Plug-in hybrid car registrations saw a strong decline of 19.9% last month, with significant decreases in three of the largest markets: Belgium (-49.2%), France (-21.7%), and Germany (-3.4%). In June, plug-in hybrids accounted for 6.1% of the total car market, down from 7.9% last year, with 66,482 units sold.

Hybrid-electric vehicles were the only powertrain category to post growth, with car registrations increasing by 26.4% in June to 321,959 units. All four of the largest markets for this segment recorded double-digit gains: France (+34.9%), Italy (+27.2%), Spain (+23%), and Germany (+16.5%). This growth pushed the hybrid-electric market share to 29.5%, up from 24.4% in June 2023.

Petrol and diesel cars

In June 2024, petrol car sales remained relatively stable, decreasing by just 0.7%. Declines in key markets such as France (-20.2%) and Spain (-7.5%) were counterbalanced by growth in Germany (+12.1%) and Italy (+6.9%). As a result, petrol cars now represent 34.4% of the market, down from 36.2% in June last year. The diesel car market saw a similar situation, with a slight decline of 0.9%, resulting in a 12.7% share of the market last June. While Germany experienced a gain of 12.4%, decreases were observed in other major markets like Italy (-18.3%), France (-8.3%), and Spain (-2.1%).