The used car market has had a crazy few years. For many people, their car is their largest or one of their largest assets and it is worth keeping up with what is happening in the market.

Used car company, getWorth, has been gathering data and building sophisticated pricing algorithms for years, which gives them deep insight into the used car market. getWorth Chief Technology Officer, Mark Ridgway, gives an irreverent tour of what has been happening.

The normal trend is for a used car to reduce in value as it ages and adds mileage.

Then came the Covid bubble. Massive disruptions to automotive supply chains during and after the pandemic caused the supply of new cars to be severely cut back. With limited new cars available, people who might normally have bought a new car went hunting used cars instead. At the same time, the car market was being juiced by extremely low interest rates. Temptingly low payments enticed many to go car shopping.

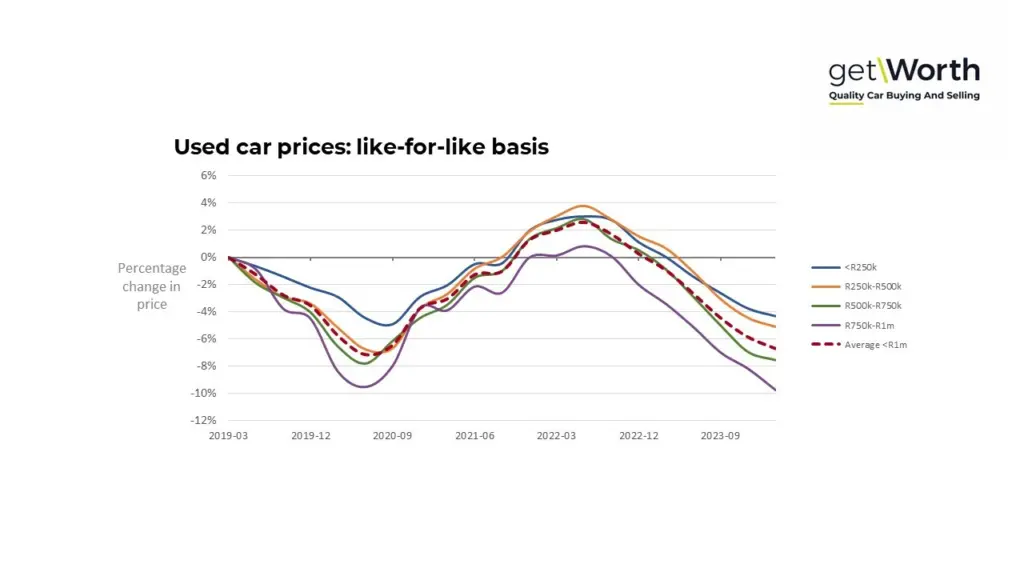

But there are only so many used cars for sale. Too much demand, too little supply. As any first-year economics student can tell you: prices will rise. And they did. GetWorth’s data showed used car prices shooting up for the first time in at least a decade.

Fast-forward about two years. Consumer confidence is taking a knock in the face of increasing interest rates, high fuel prices and the like. New cars are becoming available again. Prices start to normalise.

Then along came 2023. The used car market’s horror-show year. Interest rate increases have been brutal, with another hit every month or two. Anyone with a loan is struggling under much higher monthly repayments. New cars have flooded the market. Loadshedding is harsh, the Rand is all over the place. No-one is in car buying mode, but dealers have stock that they need to sell… which they bought at high prices and thin margins during the bubble. The market clogs up, and it’s a bloodbath in the trade. This is particularly true of the premium price segments. People need mobility, so affordable cars keep ticking along, but when times are tough, luxury takes a hammering.

Now into 2024… Interest rates have stabilized, and in our typical boiled-frog style, South Africans have got used to the higher rates. And maybe rates will drop soon. People are coming out blinking into the sun, and looking at those bright shiny cars again. But the Rand has tanked, and new cars are seriously expensive. So used cars are opening up again and some prices are levelling off.

GetWorth has produced a graph showing the like-for-like price trends for different price bands.

Refer to the attached graph: GW_Pricing. One can clearly see the picture described above.

Ridgway explains that it puts car buyers and sellers in an interesting position: “It’s a real mix. There are some bargains in some segments of the market, but others are really strong. There is opportunity for both buyers and sellers – you just need to do your homework and hold thumbs that you’re on the right side of the curve.”

But as the Starks would tell you: “Winter is coming.” And elections… Who knows what the future brings.

For more information visit www.getworth.co.za or email info@getworth.co.za