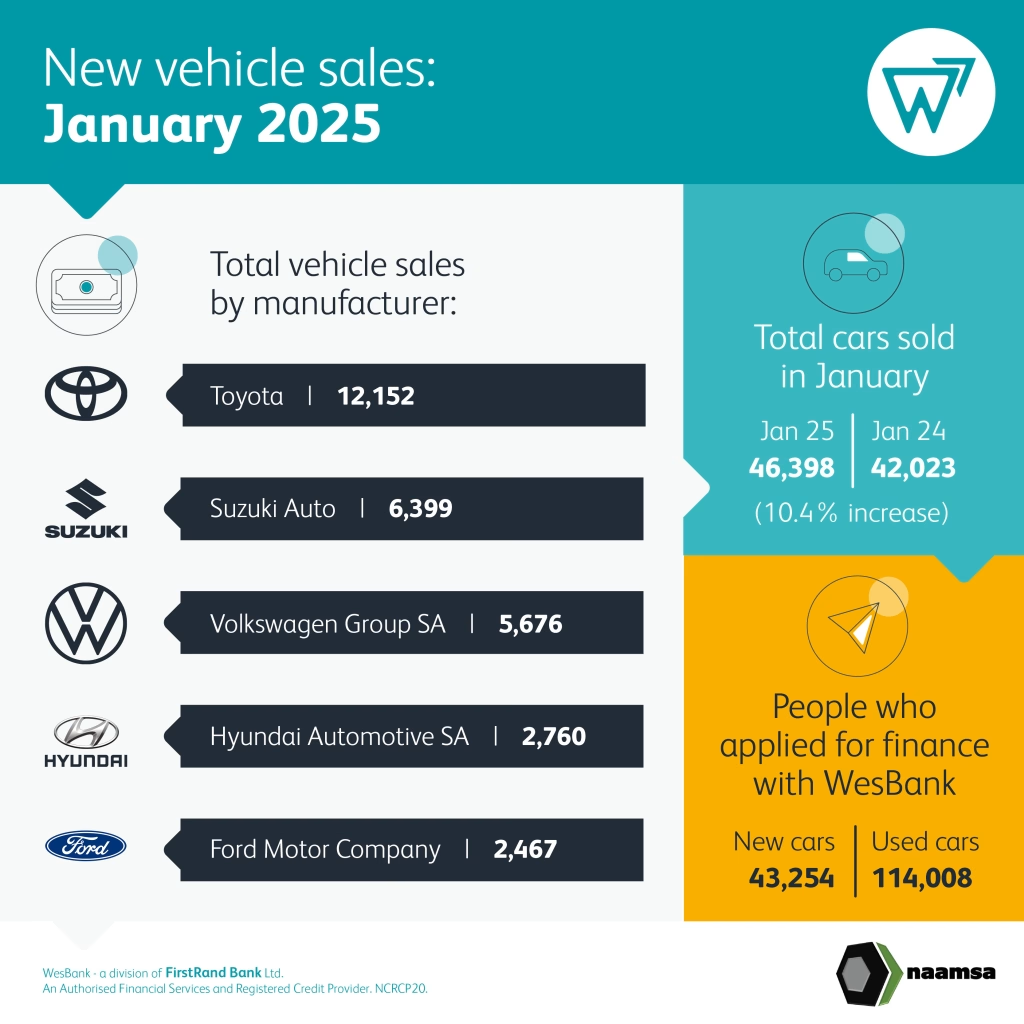

New vehicle sales started the year in hopeful spirit, registering a significant 10,4% year-on-year growth according to data from naamsa | the Automotive Business Council. The positive outlook seemingly carries on momentum from fourth quarter 2024 sales but continues to face complex market dynamics.

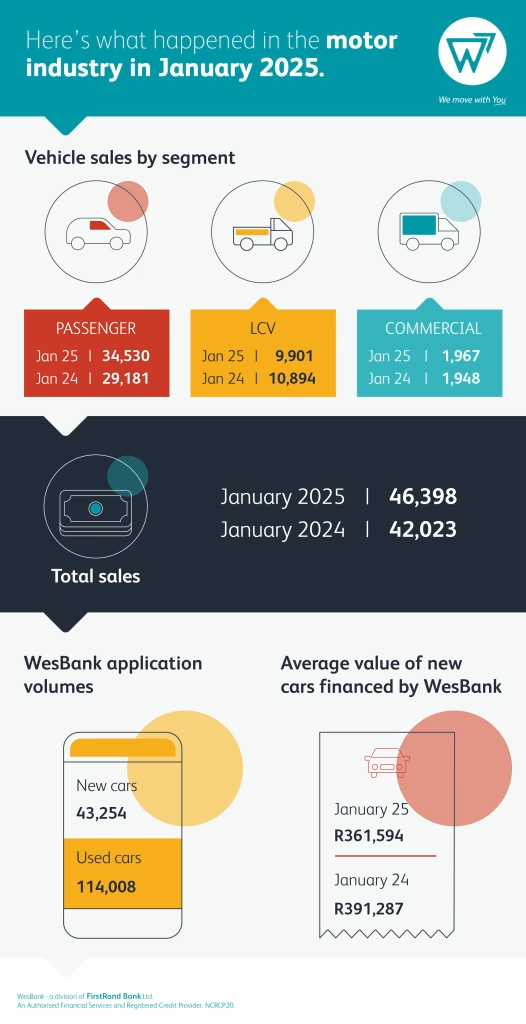

WesBank has forecast slow growth for SA’s new vehicle sales in 2025 as persistent economic headwinds and inflationary pressures continue to dampen consumer confidence and hinder growth. While January’s 46,398 unit volume would have ranked amongst the top three sales performance of 2024, some context should be considered.

“Although 10,4% growth doesn’t reflect WesBank’s slow growth forecast, it is important to note a number of impacting factors in this unusual sales month,” says Lebo Gaoaketse, Head of Marketing and Communication at WesBank. “Firstly, January volumes are traditionally boosted by lower December numbers as buyers delay purchase decisions into the new year. Secondly, last year’s sales had started off slowly and January 2024 sales were 3,8% down, providing a lower base from which to compare year-on-year performance this month.”

January sales were impacted by varying reporting processes by the manufacturers in December. While the last month of 2024 saw sales increase 2.5% year-on-year, some of these transactions would otherwise have been reported as January sales. Consequently, the two months should be considered together to get a meaningful view of the market’s true performance.

“Affordability remains a key consideration for consumer purchase decisions,” says Gaoaketse. “Data from Lightstone Auto indicating that the average selling price of passenger cars declined 2,7% last year is supported by WesBank’s book, the average deal size reducing 7,6% year-on-year.” WesBank expects the arrival of more Chinese automakers to increase competition with aggressive pricing strategies that will continue to disrupt the market in 2025.

This shift in choice continues to contribute to the performance of market segments. Passenger car sales continued their growth trend in January, increasing 18,3% to 34,530 units driven by the take-up of SUVs and more options in the segment. Light Commercial Vehicles continued their downward trend as a result, slowing 9,1% to 9,901 units.

“Another positive factor impacting January’s performance was the fact that it was a shorter sales month than January last year by two days,” says Gaoaketse. “This means that sales per day in January were significantly higher year-on-year. Lower levels of demand for new vehicles as measured by WesBank’s rate of applications provides some level of caution.”

Indebted customers will have welcomed the 0,25% cut in interest rates in January. “Further expected cuts during the year will slowly begin to address new vehicle affordability and renew business and consumer confidence,” says Gaoaketse. “However, constrained household budgets will continue to remain vigilant of spend despite lower inflationary pressures overall.”

While full-year 2024 sales declined 3%, 2025 is off to a positive start, hopefully providing impetus for the industry’s growth – however small – this year.