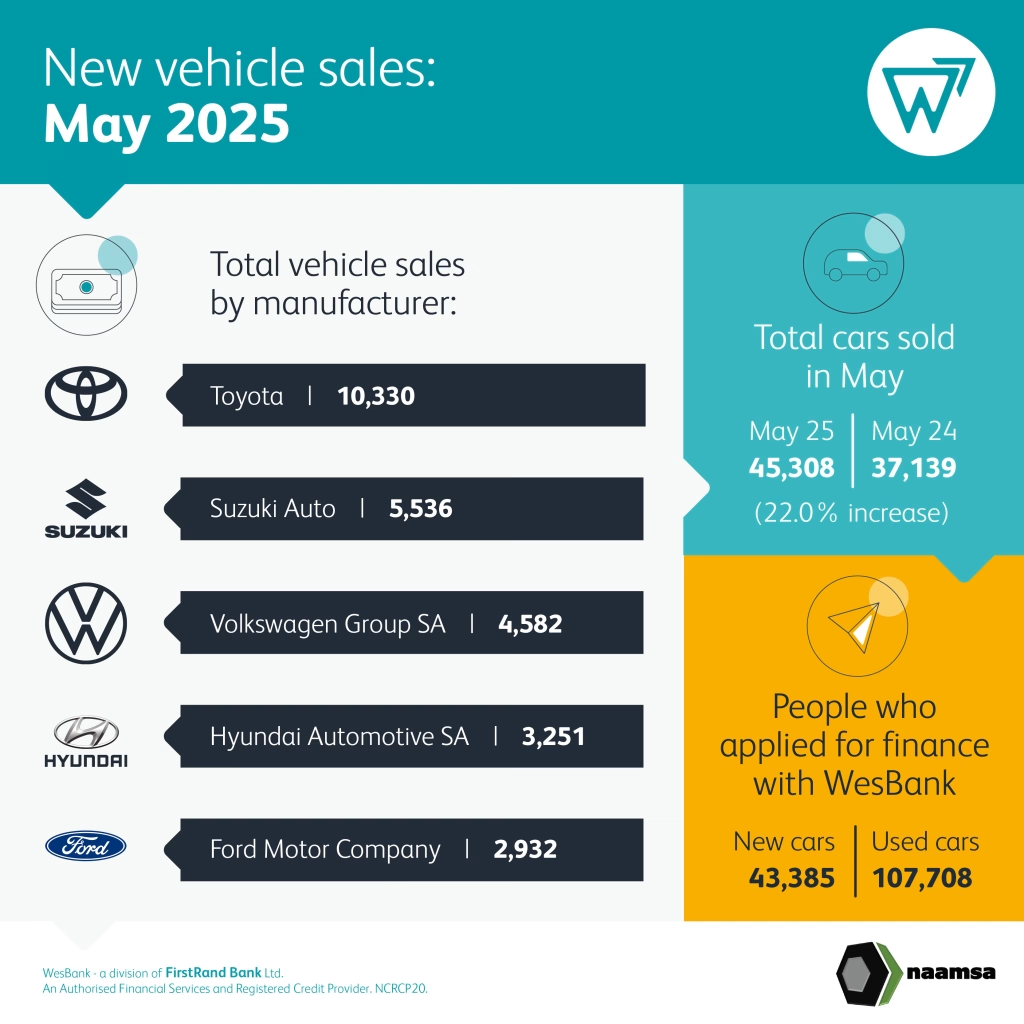

With eight consecutive months of growth, May new vehicle sales put any doubt of revitalised growth to bed, recording an impressive 22% growth in market activity year-on-year.

New vehicle sales in May recorded their biggest growth since July 2022 – when the market grew 30,9% – when the market was still re-opening after the pandemic and performance was skewed as a result. May sales weren’t necessarily skewed and remained a solid performance. However, they are compared to the country’s election month last year.

“Twelve months ago, South Africans voted at the polls, not on showroom floors,” says Lebo Gaoaketse, Head of Marketing and Communication at WesBank. “May 2024 sales were depressed and 14,2% down compared to May 2023, providing a particularly relevant context to this year’s performance.”

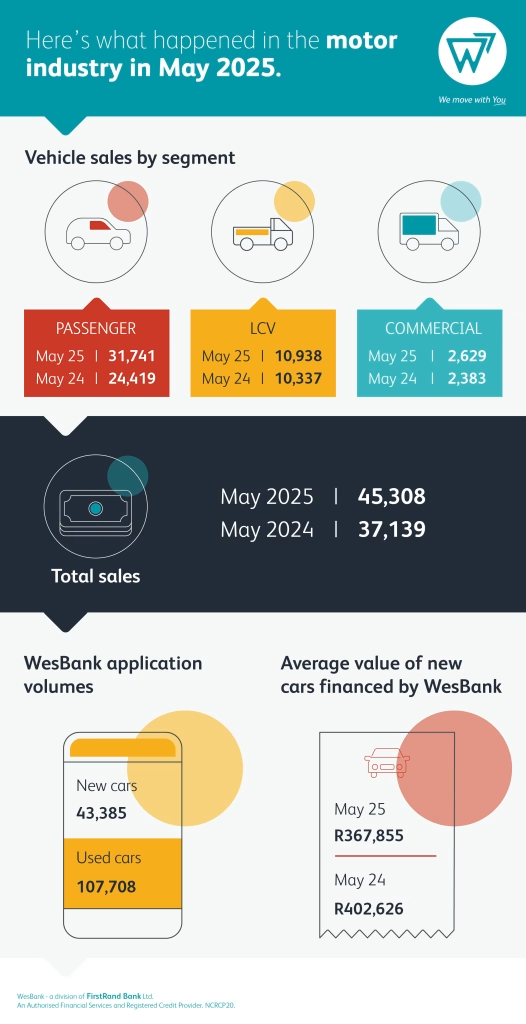

According to data from naamsa | the Automotive Business Council, May’s new vehicle market registered 45,308 sales against the 37,139 retailed in the same month last year. “First quarter sales performed better by volume, whilst displaying slower growth,” says Gaoaketse, indicating that the month was a solid volume performance, rather than an overriding reason to celebrate.

“Whilst volumes continue to be confidence-inspiring, South African household budgets remain under pressure,” says Gaoaketse. “The market’s expected slow recovery is continuing to play catch-up, but the industry should remain vigilant and will continue to have to drive innovative reasons to continue attracting consumer and business decisions to purchase new vehicles.”

Household budgets were relieved of any increase in VAT from the national budget in April but will face additional levies in the fuel price. “The feel of this impact will be delayed given the expected drop in prices this week due to currency strength,” says Gaoaketse. “But the levies are a constant new tax affecting mobility budgets going forward.”

WesBank said the momentum of new vehicle sales will undoubtedly be given an additional boost from the announcement last week by the South African Reserve Bank to lower interest rates by 0,25%. “Measures to open up affordability to South Africans are welcomed and the relief for indebted consumers and stimulus to new vehicle customers will provide continued impetus to the market this year,” says Gaoaketse.

The vast majority of WesBank finance agreements are linked to the prime lending rate, providing significant relief for customers from this month. But the pressure of overall affordability remains given the average finance amount across the Bank’s new vehicle book has decreased 8,6%.

May’s passenger car segment continued to drive market growth, up 30% to 31,741 units. Consumer sales off dealer showroom floors accounted for 87,5% of those sales, although the rental market virtually doubled its volume from May last year. Light Commercial Vehicles grew 5,8% to 10,938 units.

Year-to-date sales now stand at 231,719 units, up 12,6% with one month of the first half to go.