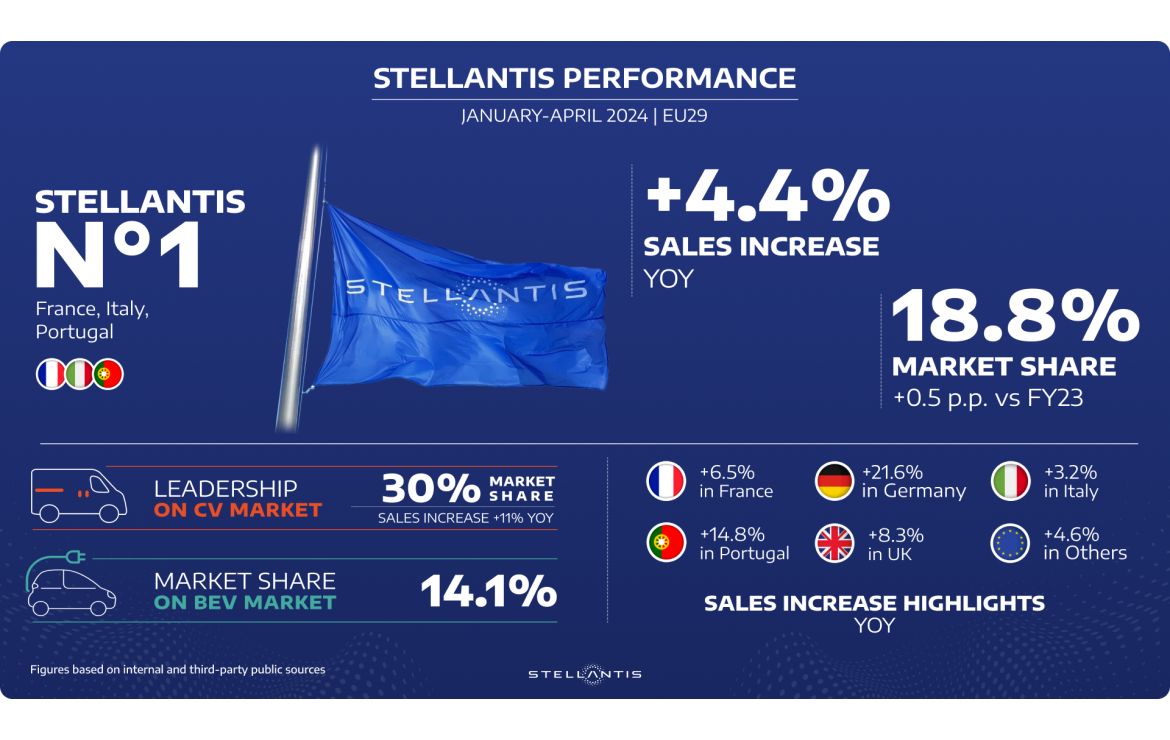

- Stellantis confirms the positive start in 2024 in the European (EU29) total market sales rankings, growing in first four months by 4.4% in volumes and confirming a market share of 18.8%, up 0.5 points vs FY23

- Germany and Portugal recorded double-digit growth, with France, Italy, UK and other European countries being all up year-over-year

- Stellantis Pro One keeps a market share of 30% and an increase in volume of 11%, leading the Commercial Vehicles business

- In the Battery Electric Vehicle (BEV) market, Stellantis reports a stable performance in sales year-over-year, with significant growth in France, Portugal and Poland, recording an overall PC+CV year-to-date market share of 14.1%.

In an increasingly challenging market, Stellantis remains resolute in its commitment to performance and customer satisfaction. Within the EU29 perimeter, Stellantis reports a 4.4% increase in volumes (PC+CV) year-on-year in the first four months of 2024, securing a market share of 18.8%, up 0.5 points vs FY23.

Stellantis dominates the French market across all segments year-to-date, including BEVs, with a strong 39.7% market share in CVs in April. The Peugeot 208 remains top selling followed by the 2008, and the Peugeot brand leads in PC+CV and PC electric vehicle markets, and four Stellantis cars are among the top 10. In Italy, Stellantis reports a 3.2% increase in PC+CV sales compared to the previous year, retaining its position as the market leader with 33.9% market share. Notably, five Stellantis models claim spots in the top ten, including the ever-popular FIAT Panda securing the #1 position and the Citroën C3 completing the podium, followed by the Lancia Ypsilon.

In Germany, Stellantis experiences a good April with remarkable 17.7% growth, bringing YTD sales to customers up 21.6%. Strong performance also in the commercial vehicles business, with sales and market share growing both in April and in the YTD. Moreover, Stellantis keeps competing for the top spot in Spain and, with over 15% sales growth in April, confirms an YTD performance of 20% market share. In the UK, Stellantis achieves an 8.3% growth (January-April) and a market share of 14.2%, with Jeep®, Peugeot and Vauxhall strong performances in the PC and CV markets. Significant sales growth is also observed in Portugal – where Stellantis is market leader – and in various other European countries.

Stellantis Pro One Commercial Vehicles business unit keep its market leadership on a YTD basis with a share of nearly 30% and a year-over-year volume increase of 11%. This performance extends across Europe, showcasing steady growth in almost all countries and an outstanding April triple-digit sales growth in Portugal (+101%).

Uwe Hochgeschurtz, Stellantis Chief Operating Officer, Enlarged Europe, commented: “Our first months’ results reflect the tough industry competition, in absence of incentives in many significant European markets. We are leading the transition to electrification in many of our key countries and our commercial vehicle offer remains unrivaled. Strong sales trend, a robust order backlog, and improving order intake suggest a positive impact also in the second quarter. With the launch of over 25 new made in Europe models across all brands, we anticipate further momentum throughout the year”.

In the BEV market (PC+CV), Stellantis keeps the market pace, with over +6% year-over-year increase across the 10 major markets, capturing a 14.1% YTD market share in EU29. Stellantis also leads in various BEV segments, securing podium positions in several major European markets. In France, BEV volumes witness double-digit growth (+64.6%), achieving a remarkable 37.4% market share, up by 8.8 percentage points compared to the previous year, with Peugeot E-208 and Fiat 500e respectively #1 and #2. Significant volume increases are also observed in Portugal (+3.9%) and Poland (+9.2%).