The euphoria of positive sales growth for South Africa’s new vehicle market in July was short-lived. But WesBank CEO Ghana Msibi remains optimistic for a slow recovery in the market. Speaking at the 2024 Festival of Motoring over the weekend, Msibi said the market was primed for improved recovery amidst new product introductions, not least from new value-oriented brands, and the prospect of lower interest rates, both significant catalysts to the market.

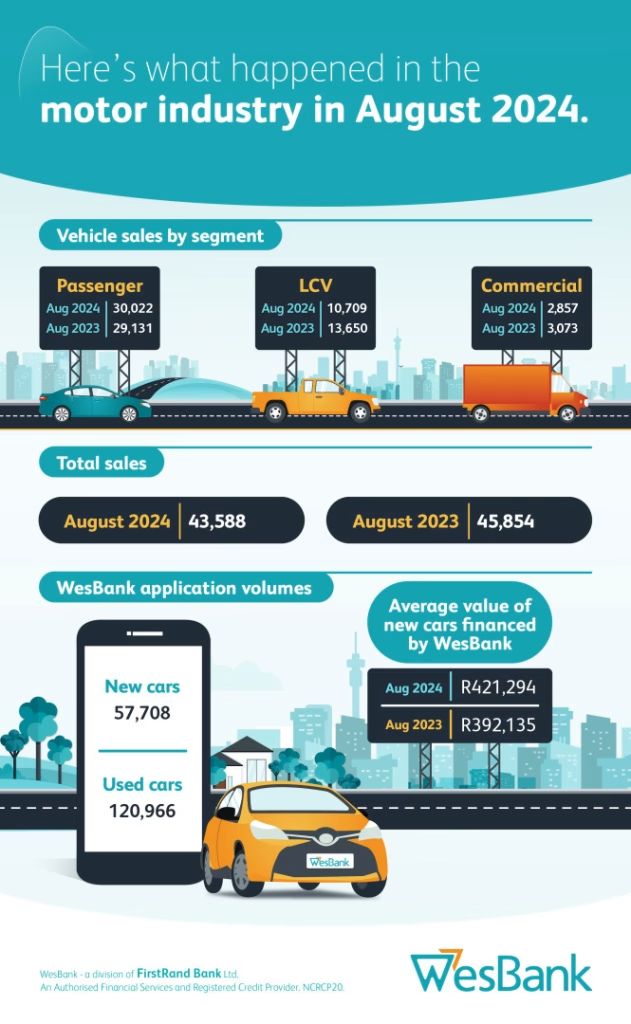

According to data released by naamsa | the Automotive Business Council, the South African new vehicle market declined 4,9% in August to 43,588 units, negative growth that was reflected in WesBank’s rate of applications.

Msibi’s analysis of market trends indicates the market being at the bottom of the trough; but warned that the climb back into positive territory would not be immediate nor fast. “The worst is behind us,” said Msibi. “What lies ahead is the start of the road to recovery: not robust growth in the initial phase, but rather shallow gains in certain pockets.”

With pending cuts in US Federal Reserve Rates, indebted South African consumers will be hopeful for a cut in interest rates when the Monetary Portfolio Committee meets in September. Interest rates remain at a 15-year high, placing pressure on household budgets and certainly impacting new vehicle sales.

“It is safe to assume that prospective buyers may have delayed their purchase decision during August in the hope of an interest rate cut in September,” says Lebo Gaoaketse, Head of Marketing and Communication at WesBank. “While inflation data looks positive to allow a reduction in the prime lending rate, the difference won’t make immediate impactful savings to indebted consumers, but it should begin a rate-cutting cycle that would benefit the market.”

The Passenger Car market fought bravely into positive territory, up 3,1% year-on-year to breach the 30,000-volume barrier with 30,022 units sold. Barring the low-volume bus market, the passenger car segment remains the best-performing sector of the market year-to-date, down 4% at the end of August.

Light Commercial Vehicles (LCVs) were a significant 21,5% down compared to August last year, with just 10,709 units registered during the month. These 2,941 units less made a significant impact on total volumes for the month. LCVs also remain the worst-performing segment year-to-date, down 10,9% compared to the first eight months of last year.

However, the slow recovery of the market continues, year-to-date sales now down 6,1% compared to the same period in 2023. This is an improvement of 0,2% over the July result.

“South Africans have more reason to be confident,” says Gaoaketse. “Relative stability has emerged after the formation of the Government of National Unity and the country’s energy availability factor has significantly improved reducing the possibility of load-shedding. With the possibility of an interest rate cut during September, there are many more pieces of the recovery puzzle beginning to fall into place.”