In the run-up to the November 2024 editions of Automechanika Johannesburg and Futuroad Expo, the second in a series of four Breakfast events for CEO’s and senior industry leaders was hosted by Messe Frankfurt South Africa at the Kyalami Grand Prix Circuit’s Conference Centre on 3 May, focusing on the Commercial Vehicle aftermarket in South Africa.

The crucial importance of the commercial vehicle aftermarket was aptly illustrated by leading sector analysts, who delivered focused and illuminating presentations.

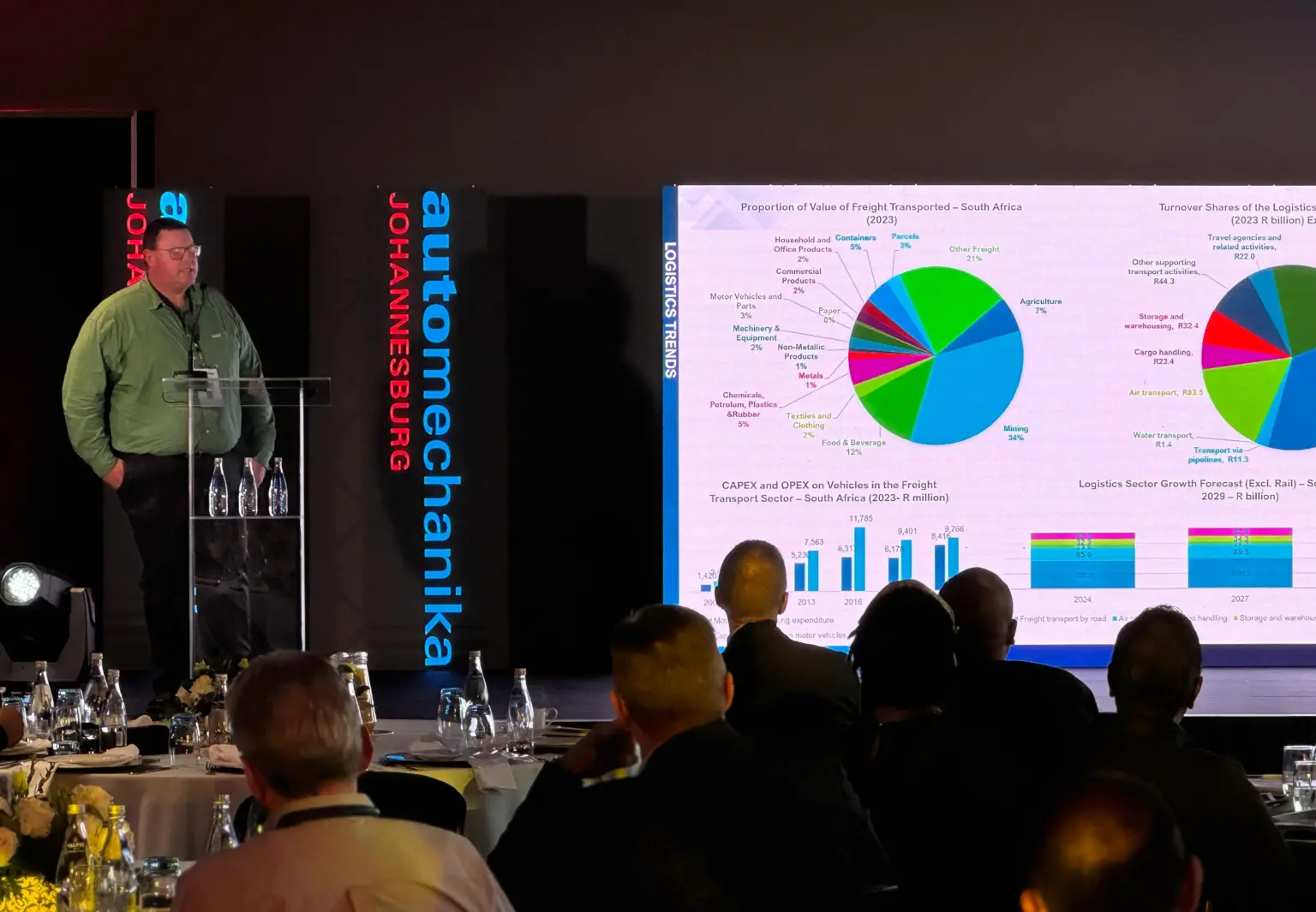

Craig Parker, Research Director at Frost & Sullivan Africa, indicated that the value of the road transport sector in SA was R 182 billion in 2023, expected to grow to R 187, 8 billion by 2027 and R 209, 4 billion by 2029, a formidable growth trajectory illustrating the dynamics of growth in road freight. Growth in total operating expenditure in the road freight sector rose from R1,4 billion in 2006 to R8,4 billion in 2023. This is corroborated by an increase in capital expenditure from R2,05 billion in 2006 to R9,8 billion in 2023 and even after discounting the effects of fuel costs and inflation, this is an indicator of the economic weight of the commercial vehicle aftermarket and the business opportunities it represents.

Parker stressed the growing importance of vehicle connectivity through various permutations of telematics systems, indicating a current percentage fleet connectivity of 38.8 in South Africa, a leader in this field and second highest globally. This is attributed to the road freight dynamics at play in South Africa and distinguishes the country’s fleet operators as power users of telematics systems. The increasing sophistication of system development in SA places local telematics service providers in an advantageous position to further expand their already formidable presence on the global market.

Menzi Nkonyane, Senior Research Analyst at S&P Global Mobility delivered an optimistic outlook on the medium and heavy commercial vehicle assembly sector in South Africa, currently dominated by the Traton Group (Scania & MAN), Daimler Truck (Mercedes-Benz, & Mitsubishi Fuso) and Isuzu (Isuzu & UD Trucks). However, there is an increasing presence of Asian brands, both in South Africa and globally. This development calls for current market leaders to focus on strategies that will help them maintain and improve their market positions. Although South Africa constitutes a very small percentage of the commercial vehicle market, it is estimated from S&P Global Mobility forecasts that over 25 000 trucks and buses, with Gross Vehicle Weight above 6 metric tons will be assembled in South Africa during 2024, which augurs well for the growth of the local truck and bus OEM sector in the country. He indicated that the medium term up to 2030 indicates a period of stable growth for the medium and heavy commercial vehicle assembly sector.

Duane Newman, Partner at Ernst &Young (EY) spoke on enabling opportunities in changing landscapes and speaking from a departure point of extensive involvement in the automotive and mining industries with a focus on sustainability, he highlighted the challenges that commercial vehicle manufacturers are facing on many fronts to ensure sustainability, such as the need for decarbonisation as dictated by legislation worldwide and optimisation of production techniques to obtain greater cost-efficiency. Added to this is the need for vehicle fleet operators to utilise fleet management technologies, create circular value chains to enhance productivity and profitability and to ensure sustainability. He stressed that sustainability of the industry was a foremost goal for manufacturers, fleet owners/operators and the commercial vehicle aftermarket. This term encompasses a wide range of disciplines and principles, the complexity of which will become increasingly challenging going forward.

If ever there was a necessity for an industry to remain dynamic and to work towards an outcome that will benefit all players, from commercial vehicle OEM’s to the owners and operators of fleets and the service providers in the aftermarket who render essential services to them, the Automechanika Johannesburg and Futuroad CEO Breakfast event provided the proof and was a stark reminder to be business-vigilant. The industry can only benefit from the powerful business and networking platform provided by Automechanika Johannesburg and Futuroad Expo, no-fluff business events dedicated to promote better business for the automotive aftermarket and the commercial vehicle sectors in the rapidly developing South and Sub-Saharan African Region.