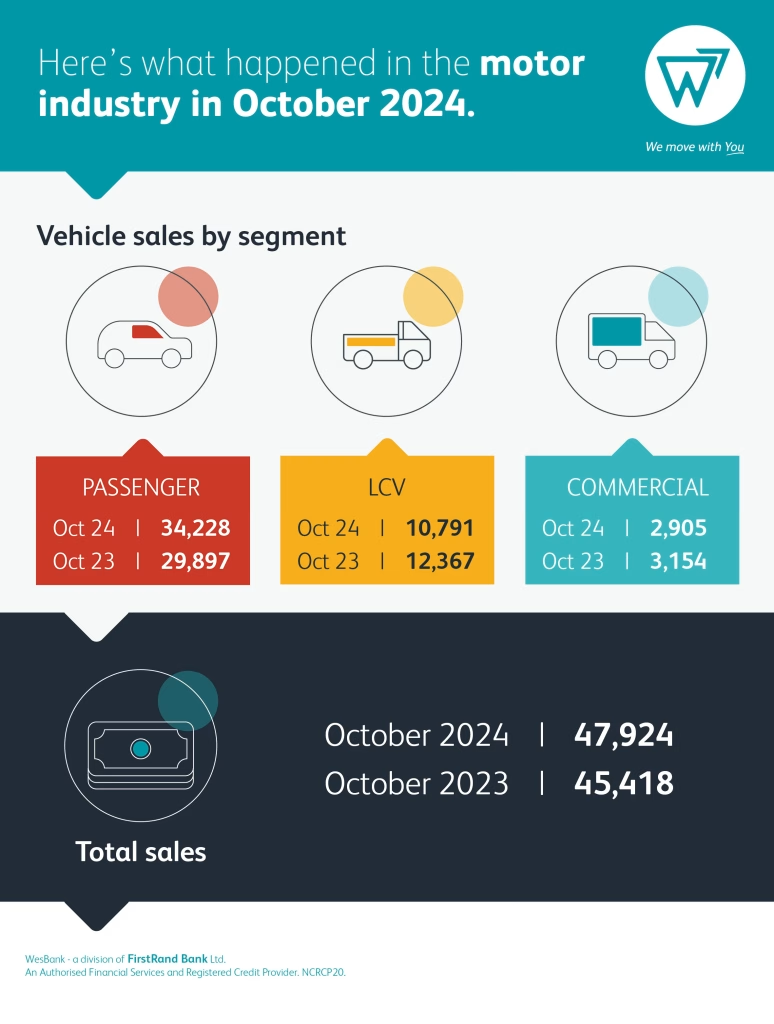

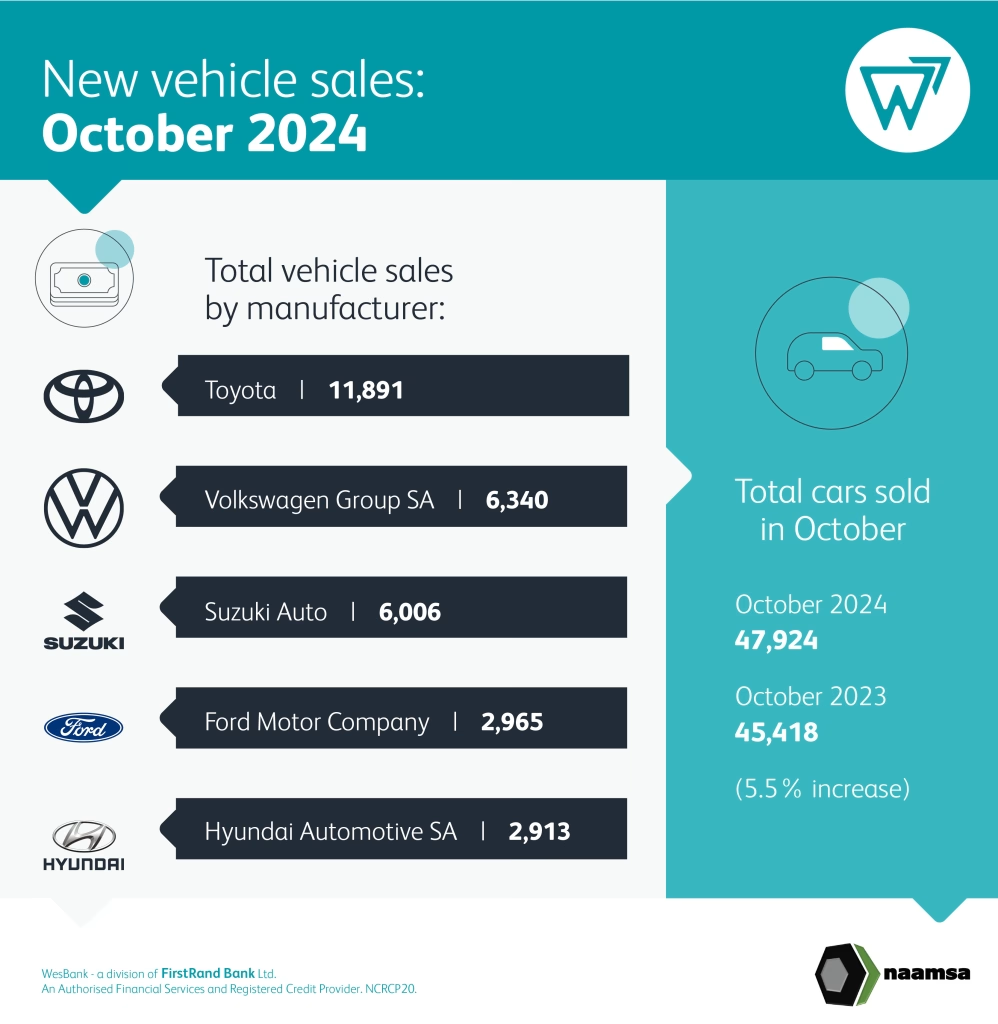

New vehicle sales reported their best performance of the year in October, the market reaching 47,924. This represents a 5,5% increase in sales driven by cyclical demand from the rental sector and an impressive performance from the passenger car segment.

October sales usurped July as the best performing month by 3,695 units and were a significant 2,506 units ahead of October last year according to data released by naamsa | the Automotive Business Council. The result provides a strong start to the final quarter and aligns with expectations for an improved second-half performance from the market.

“While positivity began creeping into the market during September, October new vehicle sales certainly provide signs of increased optimism,” says Lebo Gaoaketse, Head of Marketing and Communication at WesBank. “Rental and fleet volumes bolstered the market substantially, but an increase of 14,5% in passenger car sales overall indicates an uptick in consumer sentiment as the majority of these are retailed off showroom floors.”

Improved sentiment is being driven by a spate of positive news, not least some returned stability to the energy crisis, decreasing fuel prices, four consecutive months of declining inflation, and a stronger performance of currency against global markets. Interest rates were cut for the first time in three-and-a-half years in September and most economists expect a further cut during November as the start of an interest rate cutting cycle.

“These factors will – over time – provide much-needed relief for stressed household budgets,” says Gaoaketse. “But they will take time to stimulate new vehicle sales while those same budgets recover from rising debt.”

WesBank says the demand for credit is expected to increase, but that consumers should be careful of over-extending themselves in the euphoria of this light economic relief. “Total cost of ownership is a vital consideration when purchasing a new vehicle,” says Gaoaketse. “This has a substantial impact on affordability beyond the vehicle finance instalment.”

The strong performance of October sales has made the year-to-date market look more promising, with sales for the 10 months down 4,7% on the same period in 2023. At 425,806 sales for the year so far, the market should comfortably exceed 500,000 units but would still result in a depressed market compared to 2023.

The most positive sentiment was to be found in the passenger car market, up 14,5% to 34,228 units. This alone injected 4,331 units into the market. However, Light Commercial Vehicle sales were down 12,7% or 1,576 units to 10,791.

“We expect further relief in interest rates during November, which should continue to bolster consumer sentiment and business confidence,” said Gaoaketse. “While the market will continue to remain under pressure, all the indicators are in place for the slow recovery of the market to continue.”